In December 2024, Governor Jeff Landry signed into law a comprehensive tax reform package that is meant to address a looming fiscal cliff that Louisiana faces that will exceed $500 million over the next few years. The Governor advocated for many of these changes in an effort to streamline the state tax system and make the state more competitive for businesses, but it will have a negative impact on many people in the state, particularly lower income communities.

State Sales Tax:

In 2025, the Louisiana state sales tax of 4.45% was set to expire. Instead, the Legislature and Governor have approved an increase in the sales tax from 4.45% to 5% for five years, beginning in 2025, with a reduction to 4.75% in 2030. Combined with local sales taxes, communities like New Orleans and Baton Rouge could face overall sales tax rates exceeding 10%, among the highest in the nation.

Sales taxes are considered one of the most regressive taxes because they disproportionately impact low-income people who spend more of their income on taxable goods. Particularly as the country faces new tariffs in the coming years, this sales tax increase will hurt lower income families.

The sales tax changes did make small changes to add new digital services, such as streaming services, to applicable taxable goods.

Income Tax Changes:

The Governor signed an income tax change into law that changes the tiered tax rate into a flat rate.

Previously, there were three tax rates in Louisiana, the first $12,500 that a single person earned would be taxed at 1.85%, the next $37,500 would be taxed at 3.5%, and income over $50,000 would be taxed at 4.25%. This type of tiered tax rate is more equitable because lower income people pay less of their money and higher income people with more disposable income contribute more money into the system.

The new tax rate is a flat 3% and exempts the first $12,500 of income. This will benefit higher income earners who will now contribute less to the system which will mean fewer resources for social and state programs. Though the Governor proposes to fill these gaps with increased sales taxes, this means low income people will spend more money on taxes while higher income people do not pay as much of their income on taxes.

Invest in Louisiana found that this will result in a tax increase for people making less than $22,100 a year. Middle class people will see a small decrease about $87, but that will likely be paid through higher sales taxes. These income tax changes overwhelmingly benefit higher income earners in the state.

Corporate Income Tax and Corporate Franchise Tax Changes:

The Louisiana corporate income tax rate will be reduced from 7.5% to a flat 5.5% meaning businesses will pay less in taxes. Additionally, the corporate franchise tax will be fully phased out by 2026. These changes benefit businesses but do not guarantee that they will help workers or small businesses in Louisiana.

Tax Credits:

A number of important tax credits were maintained in the changes due to lobbying by community members including the film tax credit to support the film industry in Louisiana and the historic preservation tax credit, though the amounts for both of these programs was reduced.

The Governor continued to fully fund the Industrial Tax Exemption Program (ITEP), which provides large tax incentives for the oil and gas industry. This could cost the state $21 billion through 2040 according to a new report.

March Ballot:

Also approved by the Governor is a question that voters will see on their March ballots. The proposed constitutional amendment would dissolve a number of state fund accounts and the money would be used to pay down the state’s teacher retirement debt. By removing the need for school districts to pay those would allow them to make the teacher pay stipend from last year permanent.

-Court Amendment

-SB2 Juveniles being charged as adults at 14 years old

Weekly Update, June 10

Weekly Update, June 2

Weekly Update, May 26

Weekly Update, May 12

Cree Matlock Gives Testimony Opposing HB 445

Louisiana Third Special Legislative Session Outcomes

Geaux Far Louisiana 2023 Legislative Wins

HB 449 Passes the Senate Unanimously! HB 553 Passes the Senate with Amendments.

SB 80 Passes the House!!

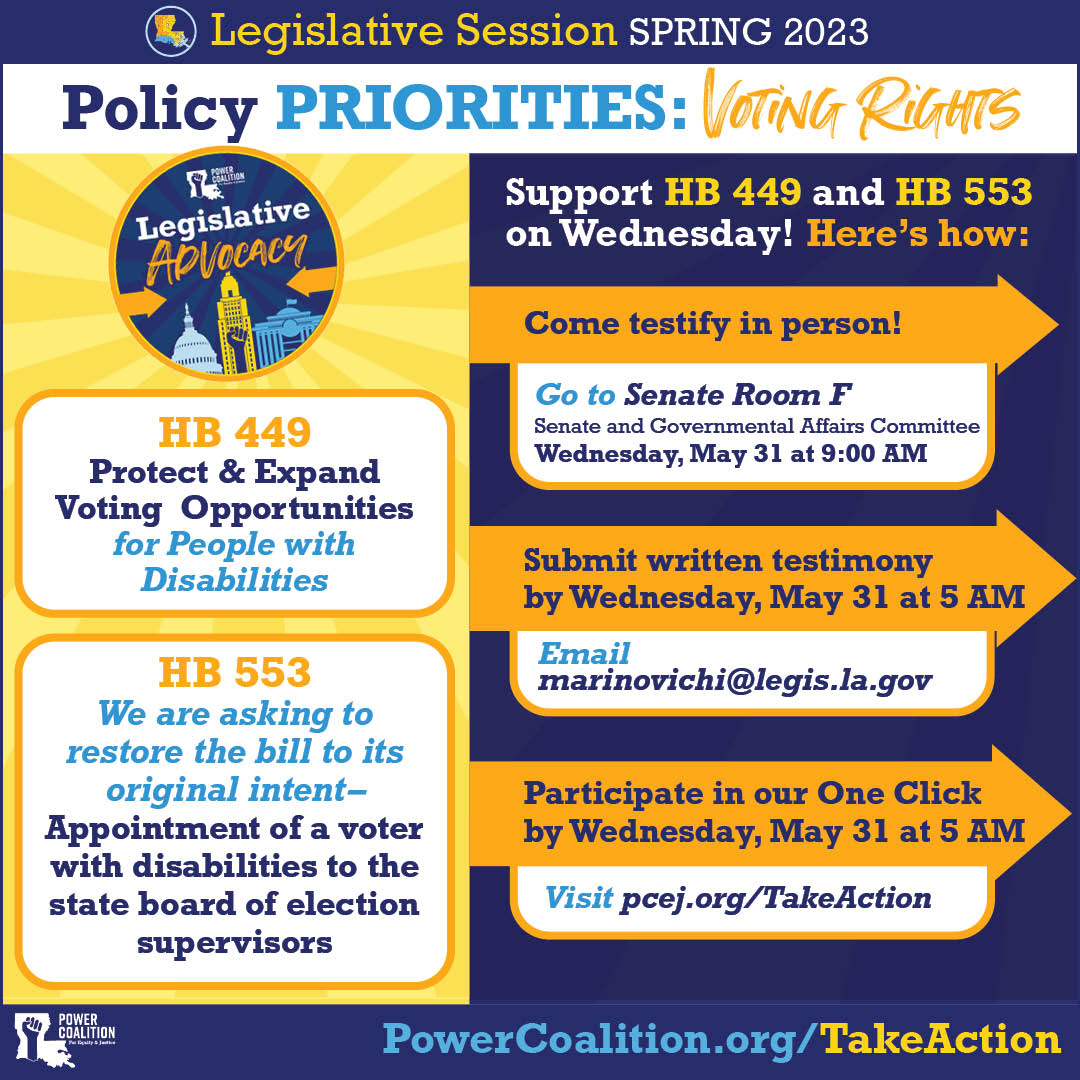

Legislative Update: May 30

Upcoming Legislative Hearings: Week of May 29

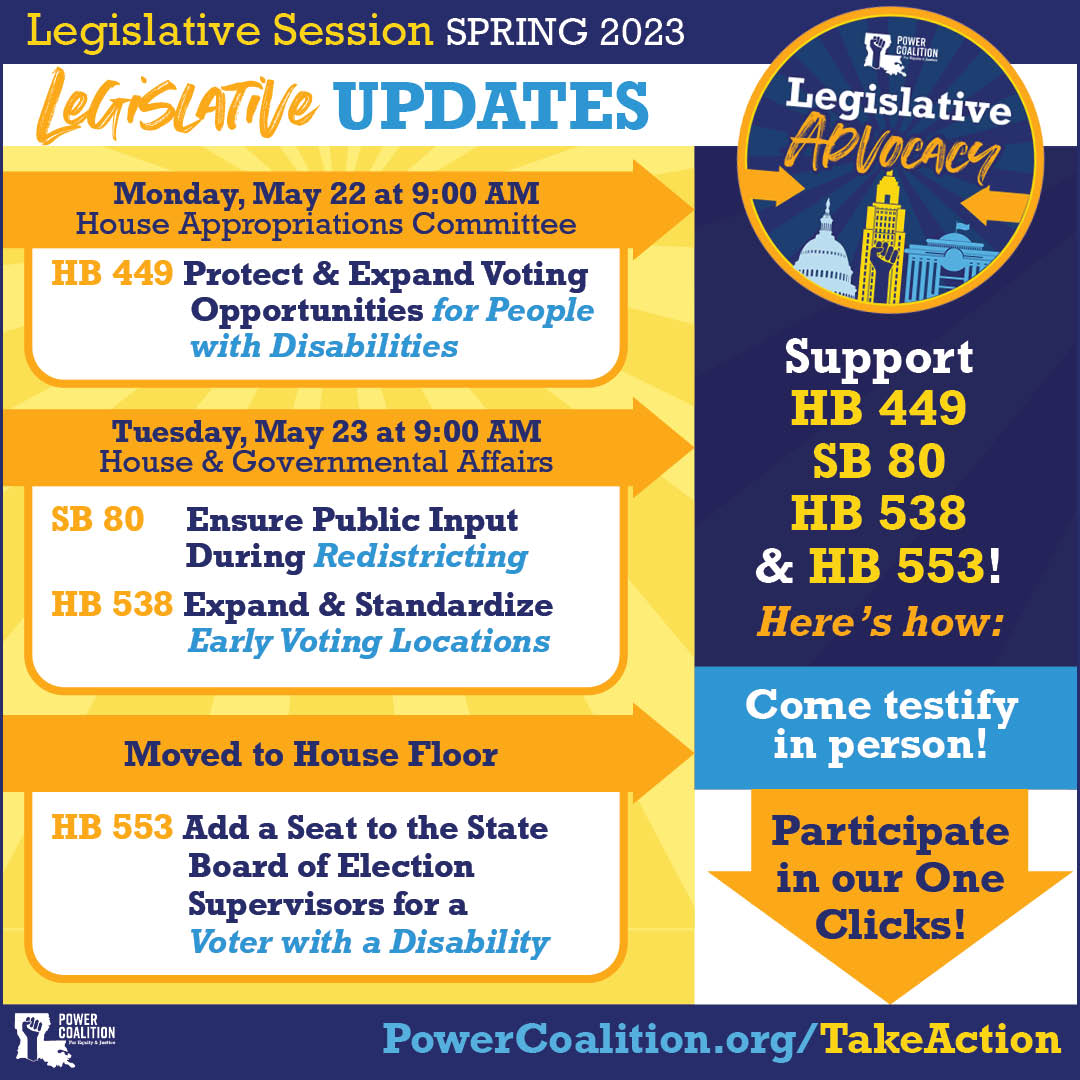

Upcoming Legislative Hearings: Week of May 22